KUALA LUMPUR, August 28, 2019 – Boustead Holdings Berhad Group (BHB) delivered an improved performance for its second quarter ended 30 June 2019, with a consolidated profit after tax (PAT) of RM84 million compared with a deficit recorded in the same quarter last year. Consolidated profit before tax (PBT) rose to RM119 million while consolidated revenue stood at RM2.54 billion.

For the first six months ended 30 June 2019 (6MFY19), the Group recorded a higher consolidated PAT of RM96 million and consolidated PBT of RM170 million. This was achieved on the back of a consolidated turnover of RM5.05 billion.

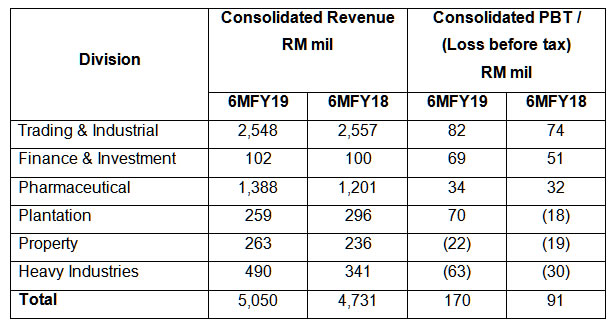

Segmental revenue and PBT for the Group’s six Divisions for the first six months in comparison to last year’s corresponding period are as follows:

Dato’ Sri Amrin Awaluddin, Managing Director of Boustead Holdings Berhad, said, “The Group’s improved earnings for the period were mainly driven by a gain on disposal of plantation land of RM120 million. All Divisions contributed positively to the Group’s bottom line, with the exception of the Heavy Industries and Property Divisions.”

The Trading & Industrial Division was the key contributor for the six-month period, posting an improved PBT of RM82 million. This was primarily supported by increased contributions from Boustead Petroleum Marketing (BPM), which recorded a higher stockholding gain as well as better margins and sales volumes. This mitigated the reduced contribution from UAC Berhad.

The Finance & Investment Division turned in a higher PBT of RM69 million. This was mainly due to stronger contributions from Affin Bank, which recorded better results due to write-back of credit impairment losses and higher net gain on financial instruments. The University of Nottingham in Malaysia also contributed positively to the Division.

The Pharmaceutical Division recorded a PBT of RM34 million, a slight increase from the previous year’s corresponding period. Despite reduced margins and higher finance costs, this was driven by improved contributions from the concession and non-concession businesses.

The Plantation Division registered a PBT of RM70 million compared with a deficit in the same period last year. This was attributable to the gain on disposal of plantation land amounting to RM120 million. However, the Division continued to be impacted by the significant drop in palm product prices. Average crude palm oil price for the six-month period was RM2,003 per metric tonne (MT), a decline of 18% from RM2,457 per MT in the same period last year, while average palm kernel price dropped by 40% to RM1,202 per MT. Fresh fruit bunches production for the period grew by 13% to 488,198 MT.

The Property Division posted a deficit of RM22 million. While the property development segment recorded positive earnings supported by contributions from Taman Mutiara Rini, this was moderated by the hotel segment which was impacted by lower occupancy and room rates, as well as a higher deficit by the property investment segment arising from start-up costs for the recently completed Nucleus Tower.

The Heavy Industries Division incurred a deficit of RM63 million, on the back of weaker results from its operating units. Boustead Naval Shipyard registered a loss for the period mainly due to revision of margins and variation of milestones achieved for the Littoral Combat Ship project, although this was partially offset by higher gross profit from ship repair activities and the Littoral Mission Ship project. Boustead Heavy Industries Corporation was impacted by lower contribution from maintenance, repair and overhaul activities and reduced share of profit from joint venture companies. MHS Aviation was also impacted by a lack of projects as well as costs to maintain its fleet of aircraft.

Moving forward, the Group will continue on improving operational efficiencies and cost optimisation measures.

Since its inception as a modest trading entity more than 180 years ago, the Boustead Group has grown by leaps and bounds to comprise more than 90 subsidiaries, associate companies and joint ventures, and has substantial interests in various sectors of the Malaysian economy. The Boustead Group’s operations are focused in six key areas; plantation, heavy industries, property, finance & investment, trading & industrial and pharmaceutical. As at 30 June 2019, Boustead Holdings Berhad’s paid-up capital was RM2.7 billion while its shareholders’ funds stood at RM5.4 billion. Market capitalisation is currently in the region of RM2.0 billion.

Forward looking statements

This release may contain certain forward-looking statements with respect to the financial conditions, results of operations and business of the Group and certain plans and objectives of Boustead Holdings Berhad with respect to these items. By their nature, forward-looking statements involve risk and uncertainty because they relate to events and depend on circumstances that will occur in the future and there are many factors that could cause actual results and developments to differ materially from those expressed or implied by these forward-looking statements.

-ends-

|

Issued on behalf of: Boustead Holdings Berhad

By: acorn communications sdn bhd For further information, please contact: Zamani Wisam at 012 350 7604 or Natalia Ghani at 012 231 4782 Or 03 7958 8348 or email: acorncommunications@acornco.com.my |