KEY HIGHLIGHTS

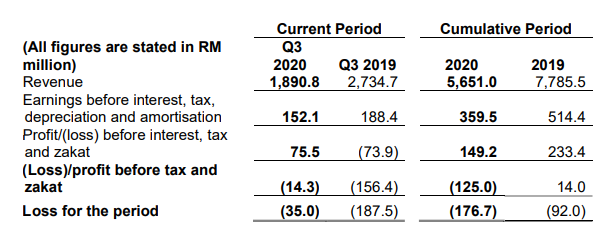

- Revenue of RM1.9 billion recorded for the third quarter.

- EBITDA of RM152 million for the third quarter.

- Loss before tax for the third quarter lowered to RM14 million, compared with a loss before tax of RM156 million in the same quarter last year.

KUALA LUMPUR, November 30, 2020 – Boustead Holdings Berhad (BHB) posted a revenue of RM1.9 billion for its third quarter ended 30 September 2020. Earnings before interest, tax, depreciation and amortisation (EBITDA) for the quarter came in at RM152 million.

For the nine-month period ended 30 September 2020, the Group recorded a revenue of RM5.7 billion, while EBITDA stood at RM360 million.

For the third quarter ended 30 September 2020

While the challenging environment brought about by the Covid-19 pandemic continued to impact the Group’s bottom line, loss before tax lowered to RM14 million for the third quarter, compared with a loss before tax of RM156 million in the previous year’s corresponding quarter. This was primarily due to the impairment of property, plant and equipment and goodwill amounting to RM161 million which affected the third quarter last year.

Dato’ Seri Mohamed Khaled bin Nordin, Chairman of Boustead Holdings Berhad, said, “Without a doubt, the current environment is expected to remain challenging. Nevertheless, we are strongly focused on progressing our Transformation Plan to put the Group on a stronger footing over the next three years, to move forward as a highperforming, sustainable and resilient organisation.”

“As we adapt to the new normal, we continue to work towards ensuring continuity of operations for our core businesses and improving efficiencies to mitigate the impact of Covid-19, while seeking out opportunities to expand into new business streams to improve the Group’s long-term prospects,” concluded Dato’ Seri Mohamed Khaled.

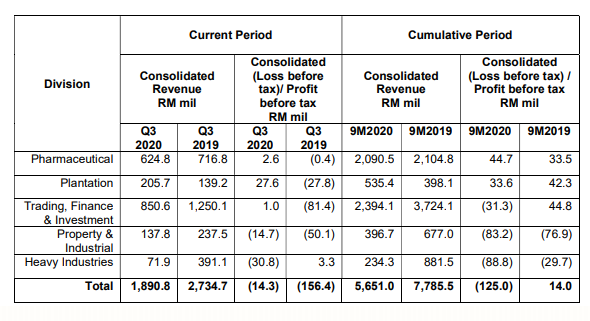

Segmental results for the Divisions for the period are tabulated below.

Pharmaceutical Division

For the nine-month period, the Pharmaceutical Division delivered a higher profit before tax (PBT) of RM45 million (9MFY19: PBT of RM34 million), reflecting a 33% increase. The key contributor was the non-concession business which saw higher sales of personal protective equipment in response to the Covid-19 outbreak. The Division’s bottom line was also bolstered by the absence of amortisation of concession rights previously recognised at the Group level.

Plantation Division

The Plantation Division recorded a PBT of RM34 million for the nine-month period, lower than RM42 million in the same period last year which benefitted from a one-off gain on disposal of land of RM120 million. At the operating level, the Division recorded a profit from operation of RM77 million (9MFY19: deficit of RM35 million), primarily due to better palm product prices and higher fresh fruit bunches production.

Trading, Finance & Investment Division

For the nine-month period, the Trading, Finance & Investment Division incurred a deficit of RM31 million. This was mainly attributable to stockholding losses recorded by Boustead Petroleum Marketing as a result of the steep drop in fuel price and lower sales volume during the Movement Control Order period. In addition, the Division’s tourism-related entities continued to be affected, offsetting the better contribution from the University of Nottingham in Malaysia. Affin Bank Berhad also turned in a lower contribution due to allowance on credit impairment losses, recognition of modification loss on loan moratorium accounts and lower net interest income.

Property & Industrial Division

The Property & Industrial Division registered a deficit of RM83 million for the ninemonth period. Despite a higher PBT recorded by the industrial segment as a result of better margins, the Division was affected by weaker performances from its propertyrelated segments. The property development segment posted a reduced PBT mainly due to lower progress billing, and the property investment segment recorded a higher loss before tax on provision of rental rebates. Meanwhile, the hotel segment continued to experience lower room occupancy and F&B revenue.

Heavy Industries Division

The Heavy Industries Division recorded a deficit of RM89 million for the nine-month period. While Boustead Heavy Industries Corporation Berhad registered a higher PBT mainly due to reversal of provision for expected credit losses, this was hampered by a deficit recorded by Boustead Naval Shipyard, on higher foreign exchange loss and finance cost. The Division was further affected by weaker contributions from the Littoral Combat Ship, Littoral Mission Ship and ship repair projects.

About Boustead Holdings Berhad

Boustead Holdings Berhad (‘Boustead’), one of Malaysia’s oldest conglomerates, is Lembaga Tabung Angkatan Tentera (‘LTAT’)’s investment arm. The diversified Group comprises more than 90 subsidiaries, associate companies and joint ventures, and has substantial interests in various sectors of the Malaysian economy.

Its operations are focused in five key areas namely plantation, heavy industries, property & industrial, trading, finance & investment, and pharmaceutical.

Since its inception as a modest trading entity more than 190 years ago, the Boustead Group has grown by leaps and bounds. As at 30 September 2020, Boustead Holdings Berhad’s paid-up capital was RM2.7 billion while its shareholders’ funds stood at RM3.5 billion. Market capitalisation is currently in the region of RM1.3 billion. For more information on Boustead, log on to www.boustead.com.my.

Forward looking statements

This release may contain certain forward-looking statements with respect to the financial conditions, results of operations and business of the Group and certain plans and objectives of Boustead Holdings Berhad with respect to these items. By their nature, forward-looking statements involve risk and uncertainty because they relate to events and depend on circumstances that will occur in the future and there are many factors that could cause actual results and developments to differ materially from those expressed or implied by these forward-looking statements.

-ends-